Budgeting for Entrepreneurs sets the stage for financial empowerment, guiding aspiring business owners through the ins and outs of managing their money like a boss. From creating budgets to making informed decisions, this guide is your ticket to entrepreneurial success.

Importance of Budgeting for Entrepreneurs

Budgeting is a crucial aspect for entrepreneurs as it serves as a financial roadmap for their business. By creating and sticking to a budget, entrepreneurs can effectively manage their cash flow, allocate resources efficiently, and make informed decisions to drive the growth of their business.

Helps in Decision Making

- Budgeting helps entrepreneurs in making informed financial decisions by providing a clear picture of their current financial situation.

- It enables entrepreneurs to prioritize expenses, identify areas for cost-cutting, and allocate resources where they are needed the most.

- Having a budget in place allows entrepreneurs to evaluate the financial implications of various business decisions before making them.

Impact on Business Success, Budgeting for Entrepreneurs

- Effective budgeting plays a key role in the overall success and sustainability of a business.

- It helps in monitoring the financial health of the business, ensuring that it is on track to meet its goals and objectives.

- By tracking expenses and revenue against the budget, entrepreneurs can identify any deviations and take corrective actions promptly.

Creating a Budget as an Entrepreneur: Budgeting For Entrepreneurs

Creating a budget for a new business venture is crucial for the success of any entrepreneur. It involves careful planning and estimation to ensure that the financial aspects of the business are well-managed from the start.

Steps to Create a Budget

- Identify and list all potential sources of income for the business, including sales revenue, investments, and other funding.

- Estimate the expenses that the business will incur, such as rent, utilities, salaries, and costs of goods sold.

- Allocate funds for one-time costs like equipment purchases or renovations, as well as for ongoing operational expenses.

- Consider setting aside a contingency fund for unexpected costs or emergencies.

- Review and adjust the budget regularly based on actual income and expenses to stay on track.

Best Practices for Estimating Income and Expenses

- Conduct thorough market research to understand potential sales and pricing strategies accurately.

- Use historical data or industry benchmarks to estimate expenses realistically.

- Factor in seasonality and economic trends that may impact income and expenses.

- Consider both fixed costs (rent, salaries) and variable costs (utilities, raw materials) in your budget.

- Be conservative in your estimates to avoid overspending and ensure financial stability.

Tools and Software for Budgeting

- Utilize spreadsheet software like Microsoft Excel or Google Sheets for manual budgeting and tracking.

- Explore budgeting apps such as Mint, YNAB, or QuickBooks for automated budget management.

- Consider using accounting software like FreshBooks or Xero for more advanced budgeting features and financial reporting.

- Invest in cloud-based platforms for easy access to budgeting information from anywhere at any time.

Monitoring and Adjusting Budgets

Regularly monitoring and adjusting budgets is crucial for entrepreneurs to ensure financial stability and success in their ventures. By keeping a close eye on their financial performance and making necessary adjustments, entrepreneurs can stay on track with their goals and make informed decisions for the future.

Importance of Regular Monitoring

Monitoring a budget allows entrepreneurs to track their actual financial performance against the budgeted amounts. This helps them identify any discrepancies, areas of overspending, or potential cost savings opportunities. By staying vigilant, entrepreneurs can proactively address financial issues and make timely adjustments to avoid negative impacts on their business.

Strategies for Tracking Financial Performance

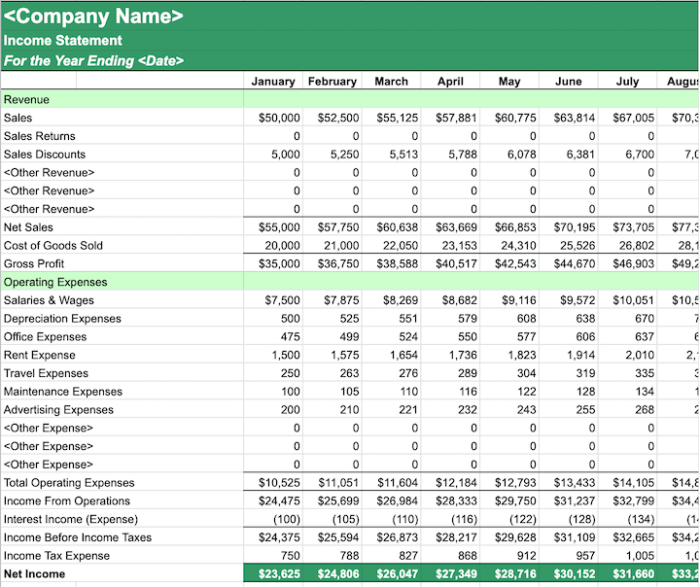

- Regularly review financial statements, such as income statements and cash flow statements, to compare actual numbers with budgeted amounts.

- Utilize accounting software or budgeting tools to automate the tracking process and generate detailed reports for analysis.

- Hold regular meetings with key stakeholders to discuss financial performance and identify areas for improvement.

Adapting and Adjusting Budgets

- Revisit the budget periodically to reflect changes in the business environment, such as market conditions, customer demand, or unexpected expenses.

- Consider reallocating funds from lower priority areas to cover essential expenses or invest in growth opportunities.

- Stay flexible and be prepared to make quick decisions to adjust the budget in response to unforeseen events or economic fluctuations.

Budgeting Tips for Entrepreneurs

Effective budgeting is crucial for the success of entrepreneurs. Here are some practical tips and techniques tailored specifically to help entrepreneurs manage their finances efficiently.

Prioritizing Spending and Resource Allocation

- Identify essential expenses: Start by listing all necessary expenses for your business, such as rent, utilities, and salaries.

- Allocate funds strategically: Determine the most critical areas where your money should go to support business growth and sustainability.

- Consider ROI: Prioritize spending on investments that offer the highest return on investment to maximize profitability.

Avoiding Common Budgeting Mistakes

- Avoid underestimating costs: Be realistic when estimating expenses to prevent financial surprises down the line.

- Failure to track expenses: Keep detailed records of all transactions to stay on top of your financial situation and make informed decisions.

- Ignoring emergency funds: Set aside a portion of your budget for unexpected expenses or economic downturns to ensure financial stability.